Browne’s statements about moving government deposits from GBC are enough to sink the bank, Dr Daniel contends

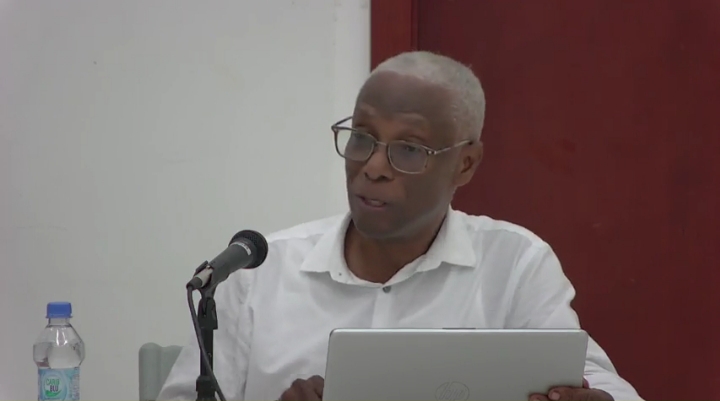

Former university lecturer Dr. George Daniel says that Prime

Minister Gaston Browne’s recent comments about the Global Bank

of Commerce (GBC) pose a greater risk of destabilizing the bank

than actions taken by depositor Jack Stroll.

Last Thursday, February 22, Browne said the businessman’s current

lawsuits could cause other GBC customers to lose some of their

savings or investments in the financial institution.

Reportedly, for about five years now, Stroll has been trying to

withdraw his money from the bank, and the matter finally led to him

taking legal action.

In doing so, the businessman failed to honour an agreement for

“secrecy,” Browne alleged during last week’s sitting of the Lower

House, and put GBC’s viability at risk.

However, Dr. Daniel says the prime minister’s previous statement –

that the Government was removing its holdings with the bank in

order to reduce its risk – actually served to place the bank in

jeopardy.

Browne needs to think before he opens his mouth, Dr. Daniel

cautions, adding that what Stroll is doing now – withdrawing his

money to reduce his risk –

is no different from what the Government says it will do.

In fact, according to the former lecturer, the prime minister’s

statement would sink any bank.

Meanwhile, Dr. Daniel says, Browne’s statement about the

mechanism he plans on using to reduce the Government’s exposure

does not make sense.

If the Government is not honouring its commitment with Treasury

bonds, Dr. Daniel says, then how does it plan to raise the $600

million to make up the budget shortfall.

The 2024 budget is $1.8 billion; however, the Government’s revenue

amounts to about $1.2 billion, which leaves the deficit to be raised

through Treasury instruments.

But given the current situation, Dr. Daniel wonders who is going to

take up any Treasury bills issued on the Securities Exchange by the

Browne Administration, when it is not honouring its obligations.

That was former university lecturer Dr. George Daniel.

Meanwhile, Dr. Daniel says, yet again, that the Government of

Antigua and Barbuda has a finance-management problem, as it is

not prudent with its spending nor efficient with its tax collection.

He underscores that the Gaston Browne Administration is broke

because of bad management of the economy.