Court papers say delayed payment for Global Bank depositors was intended to secure ALP’s chances in General Election

Further to the report that Attorney-General Steadroy “Cutie” Benjamin was sued by a depositor of the Global Bank of Commerce (GBC), on May 23, it appears that the Government’s first default on the repayment of US$10 million had implications for the success of the Antigua Labour Party (ALP) in the January 18 General Election.

Sources tell REAL News that – because the polls were closer than two weeks away – Prime Minister Gaston Brown needed to avert a financial disaster for the Bank and a consequent political disaster for the Antigua Labour Party.

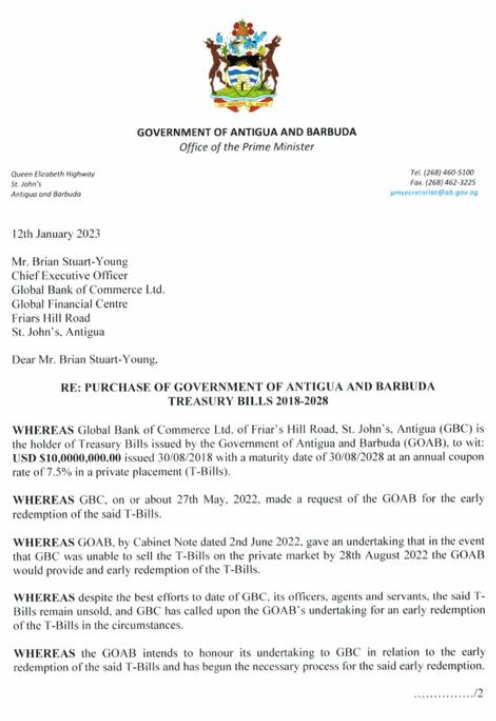

According to the documents filed in the High Court, in late May 2022, the Bank had sought relief from the Browne Administration by way of “the early redemption” of a Treasury Bill held by depositor Jack Stroll and his company, Neverland Services S.A., as collateral for his deposits with GBC.

The documents state that the Bank was facing “financial difficulties” and threats from the depositor “to take legal action … and possibly place GBC into receivership.”

The Cabinet agreed that it would accommodate the Bank with the understanding that GBC would attempt “to sell the T-Bill withing ninety (90) days from 27th May 2022.”

However, not only was the Bank unable to sell the Bill within that period, but the Government also “defaulted on its obligation … as required by Cabinet’s decision on 1 June 2022” – according to an affidavit filed by Brian Stuart-Young, the Bank’s chief executive officer.

The matter proceeded to litigation and a consent order was agreed upon, with the Government being required to satisfy the terms by January 6, 2023. However, the Browne Administration, again, was unable to come up with the US$10 million by that date.

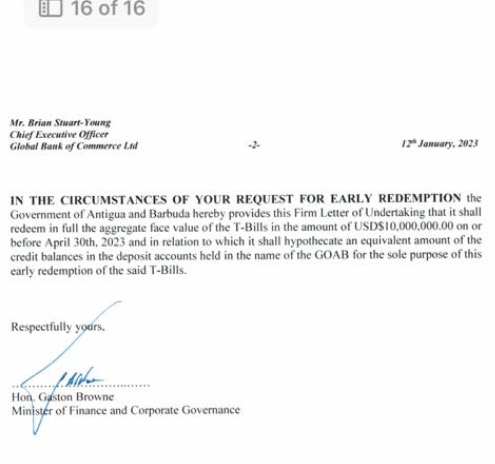

Accordingly, in his capacity as minister of finance, on January 12 this year, Browne “issued a Firm Letter of Undertaking” that acknowledged the Bank’s failure to redeem the T-Bill and the Government’s own commitment to do so by April 30 of this year.

The Letter also legally committed the credit balances in the Government’s deposit accounts – to the value of US$10 million account – to honour the debt.

The statement of claim notes that the Letter, “while addressed to Mr. Stuart-Young, was always intended to benefit the Claimants and created an implied contract between the Claimants and [the Government of Antigua and Barbuda].”

Underscoring the political implications for Browne, the document adds that “The Firm Letter of Undertaking was issued just prior to the general election when the Minister of Finance and Corporate Governance, as the serving Prime Minister, was under intense political pressure regarding the financial wellbeing of the banks in Antigua and Barbuda.”

It acknowledges that “this was an important election issue. The failure of GBC right before the election was something that would likely have put the Prime Minister’s re-election at considerable risk and certainly would have brought the Finance Ministry’s oversight obligations into question.”

As a result, the document implies, the Firm Letter of Undertaking was not issued in good faith. Instead, it was “intended by [Browne] to induce, and did in fact induce, the Claimants to forbear from taking further enforcement action against GBC until 30 April 2023 (well after the 18 January 2023 general election).”

The April date having passed without the Browne Administration having made good on the Letter, Stroll and his company are now suing the Government, through Attorney-General Benjamin.

The Claimants are asking that the Court order the Government to redeem the Treasury Bill in full, or pay damages in the amount of US$10 million. They are also seeking interest on the damages; costs of the legal proceedings; and any further relief that the Court deems fair.

When this story broke in 2022, Prime Minister Browne accused Stroll – a dual citizen of Canada and Antigua and Barbuda who resides here – of being greedy for demanding his deposits in full. He also accused him, then, of having a political agenda.

Given the Government’s failure to acquire the money on the international bond market, pundits have said that Browne’s aggressive acquisition of the Alfa Nero luxury yacht – for sale – was driven, in part, by the need to compensate Stroll and Neverland Services, S.A.

However, sources are claiming that, since its recent acquisition, the vessel has become the subject of a lawsuit. REAL News has not been able to confirm this report.