Lovell condemns Browne’s secret cancellation of US$200 million bond and speculates on reasons the deal fell through

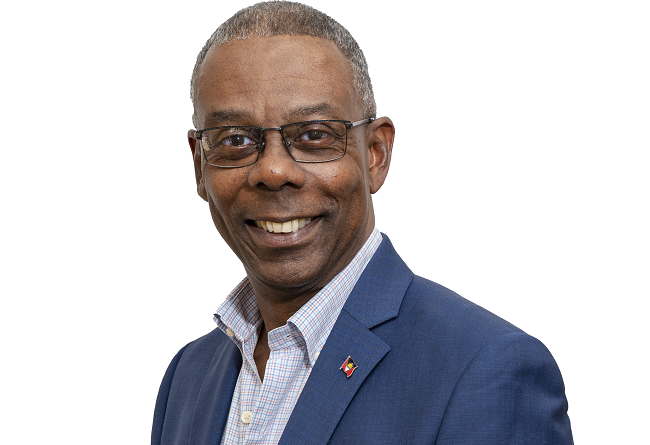

“A comedy of errors.” This is how Harold Lovell describes Prime Minister Gaston Browne’s announcement that his Administration has cancelled the US$200 million bond that it floated on the international market.

During Tuesday’s sitting of the Lower House, Barbuda MP Trevor Walker asked Browne, the Minister of Finance, about the status of the bond. Browne confirmed that the bond was indeed cancelled.

In February, during the 2022 Budget presentation, Browne reported to the Nation that the bond had been oversubscribed, and he subsequently indicated how the funds raised would be spent.

With the cancellation of the bond, Lovell says it now appears the Government was counting on a single investor, or entity, and not the multiple investors one would expect from the use of the term “oversubscribed.”

He says that news of the bond’s cancellation has dashed the hopes of many, including the Social Security pensioners and the former Jolly Beach and LIAT workers who were sent home without their severance.

As a former Minister of Finance in the United Progressive Party Administration, Lovell points out that EC$540 million represents 50 percent of the national budget and is a significant part of the country’s Gross Domestic Product; accordingly, this money could have been used to boost the economy.

Lovell says the country’s credit record could have been among several determining factors which caused the investor to pull out.