Lack of manpower to reprice goods challenges businesses, and will affect consumers briefly, says Consumer Affairs director

Businesses are already facing challenges related to the newly

increased Antigua and Barbuda Sales Tax (ABST) and are reporting

insufficient manpower to re-price goods.

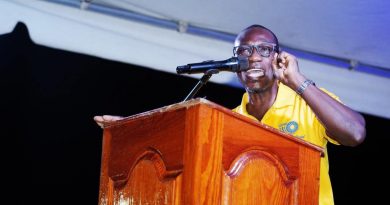

On Tuesday, January 2, says Orrin Steele, director of the Prices and

Consumer Affairs Division, the Division was flooded with calls from

various stakeholders requesting information on handling the

situation.

The 2 percent hike in the ABST, moving it from 15 to 17 percent,

took effect on January 1, 2024.

While businesses would have updated their systems to reflect the

sales tax increase, Steele says the difficulty lies with having the

manpower to change the physical items on the shelves.

He anticipates that this situation will pose some difficulty for

consumers, as well, at least for this week.

There is a basket of essential goods that is exempted from the ABST,

and the Government has promised that these items will not be

impacted by tax increase.

There are other price-controlled goods that do not attract the ABST.

These are usually monitored by the Division and should not be

impacted by any hike in the sales tax, Steele says.

However, the director acknowledges that while an item might not

attract ABST directly, it may do so indirectly.

As an example, he cites water as a non-taxable item. However, the

bottles in which the commodity is sold might be taxed, he says, and

the ABST increase would be passed on to the consumer purchasing

that water.

That was Orrin Steele, director at the Prices and Consumer

Affairs Division, speaking on State Television.