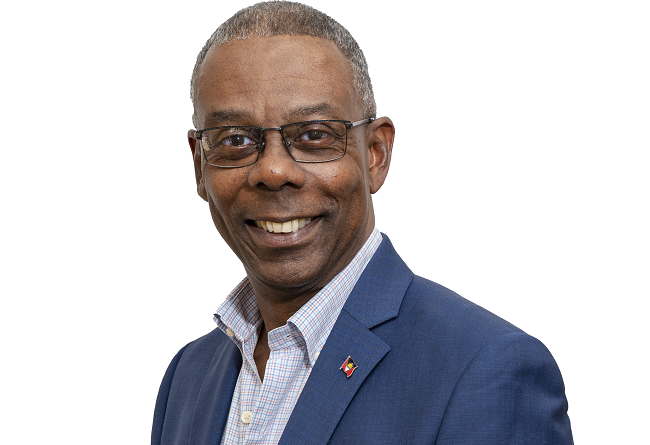

A simpler registration system and a flat tax according to size would serve unincorporated businesses better, Lovell says

The United Progressive Party (UPP) is carving out ways to make the operation of small businesses simpler, especially as it relates to the filing of taxes.

Harold Lovell, Political Leader of the Party, says the Unincorporated Business Tax creates an inconvenience for entrepreneurs who operate sole-trader small businesses and have to file taxes at the Inland Revenue Department (IRD).

Since these sole operators are often challenged to keep track of all their records and file at the required time, a very simple registration system is needed for unincorporated businesses, he says.

Accordingly, Lovell is suggesting that a flat rate be introduced and applied.

He notes, however, that businesses would be required to pay based on their size; and consultations would determine the rates that apply to micro, small, and medium operations.

Other mechanisms, such as random audits, would need to be undertaken to ensure that businesses classify themselves under the correct category, he notes, since larger entities might be tempted to classify themselves as small businesses.

The UPP Political Leader says the Party’s business development goals have been highly commended by a number of industry professionals.

The Unincorporated Business Tax brings in about $5-6 million annually.